The Infrastructure and App Cycle: Strategic Thinking for Emerging Infrastructure Providers

Finding signal from noise in a gold rush is no easy task; keeping a level head and executing on strategy is crucial to win.

Welcome to another edition of the DeFi Mullet newsletter! In this newsletter, I hope to cover the arguably boring world of the most anticipated collab of the decade: Fintech x DeFi (ft. policy, markets, tech, product, etc).

If you are one of the fine folks who get a thrill from these topics, press subscribe below!

Rushing to find gold in novel markets

For all the trials and tribulations that crypto has had to endure this year, one thing that has stood out is the quest to find sustainable business models that scale. Many have tried their hand at developing ambitious new monetisation structures but market realities have consistently brought these approaches crashing back to earth. This post will seek to unpack the revenue models of those operating at the intersection of DeFi x Fintech.

It is important to note the role of composability as it is a feature common to both web3/DeFi and Fintech. This post will address the role of commoditisation and highlight the pressure teams will inevitably experience when managing the unit economics of their products in fundamentally novel markets. As we enter a prolonged crypto winter, projects that build with strong fundamentals will undoubtedly endure the test of time.

It is currently infrastructure’s moment → when winter turns to spring, keep your eyes open for what may become the next wave of applications.

Background

In 2018, Union Square Ventures published a blog titled “The Myth of The Infrastructure Phase” where USV outlined a thesis pertaining to the view that infrastructure development is cyclical rather than developed in prolonged phases: apps → infra → apps → infra → apps.

First, apps inspire infrastructure. Then that infrastructure enables new apps.

A similar ebb and flow is seen in fintech as recently outlined by Simon Taylor in his newsletter Fintech Brain Food:

Vintage 0 is anything pre-2010. We did have new companies built back then in infrastructure, but they'd often grow to a certain size and then be bought by someone bigger (so think Banno acquired by Jack Henry, Fiserv acquiring Monetise). FIS has spent more than $52bn on M&A, Fiserv in the $48bn ballpark.

Vintage 1 is companies who have IPO'd (or should have), so the consumer example would be CashApp and Chime, and the infrastructure supplier vintage is Marqeta and Galileo, respectively. Vintage 1 would also include the merchant side payments companies (Stripe, Block, Adyen, etc.) and some early onboarding companies like Socure

Vintage 2 is anything after ~2014 to 2016 (I know that's vague). This would include most of the BaaS providers (Unit, Bond, Treasury Prime), the next-gen issuer processors (Lithic, Highnote), and the entire stack of supporting services (Alloy, Sardine, Unit 21, Drivewealth, and literally every other Fintech infrastructure company).

The infrastructure → app cycle is applicable to the development of financial services companies but with one addition, regulation. The role of regulation should not be underestimated as it is a tool that can be utilised by governments to incentivise or disincentivise investment. Regulation has been utilised by many governments in countless circumstances to spur innovation and attract talent, capital, and promote competition (think the Financial Conduct Authority’s competition mandate and regulatory sandbox in the UK). Do not underestimate the power and momentum good regulation can unlock - the opposite is also true.

Whilst being in the middle of an infrastructure cycle, the DeFi x Fintech crossover is also in the middle of a focus on manufacturing rather than distribution. As noted in Frank Rotman’s The Copernican Revolution in Banking, several types of players were foretold to emerge in fintech, each with a different profile across manufacturing and distribution. We are at a similar moment in DeFi x Fintech: there is a focus on establishing market dominance across an infrastructure/manufacturing layer that will be omnipresent in the future of a dual-track financial services ecosystem → this is a rare opportunity for infrastructure builders to have a shot at becoming a Visa-style incumbent.

Business Models that have worked so far

This is illustrative, not exhaustive. Take note of their simplicity → all of them require significant volume.

Strategy Breakdown

For DeFi x Fintech, it is clear that we are currently in an infrastructure ebb of the app → infra cycle. So, with that in mind, how should folks building DeFi x Fintech infrastructure companies think about go-to-market and establishing dominance in a space where the primary drivers of revenue may not exist yet i.e. servicing a nascent application layer. It is a tough question that many folks who have recently raised pre-seed, seed, and even Series A will undoubtedly have to face over the next 6-18 months. Further, with so much dry powder waiting to be deployed it is important that investors, in their role of assuaging market inefficiency, reflect on the following when allocating capital: is this team adequately positioned to actually win?

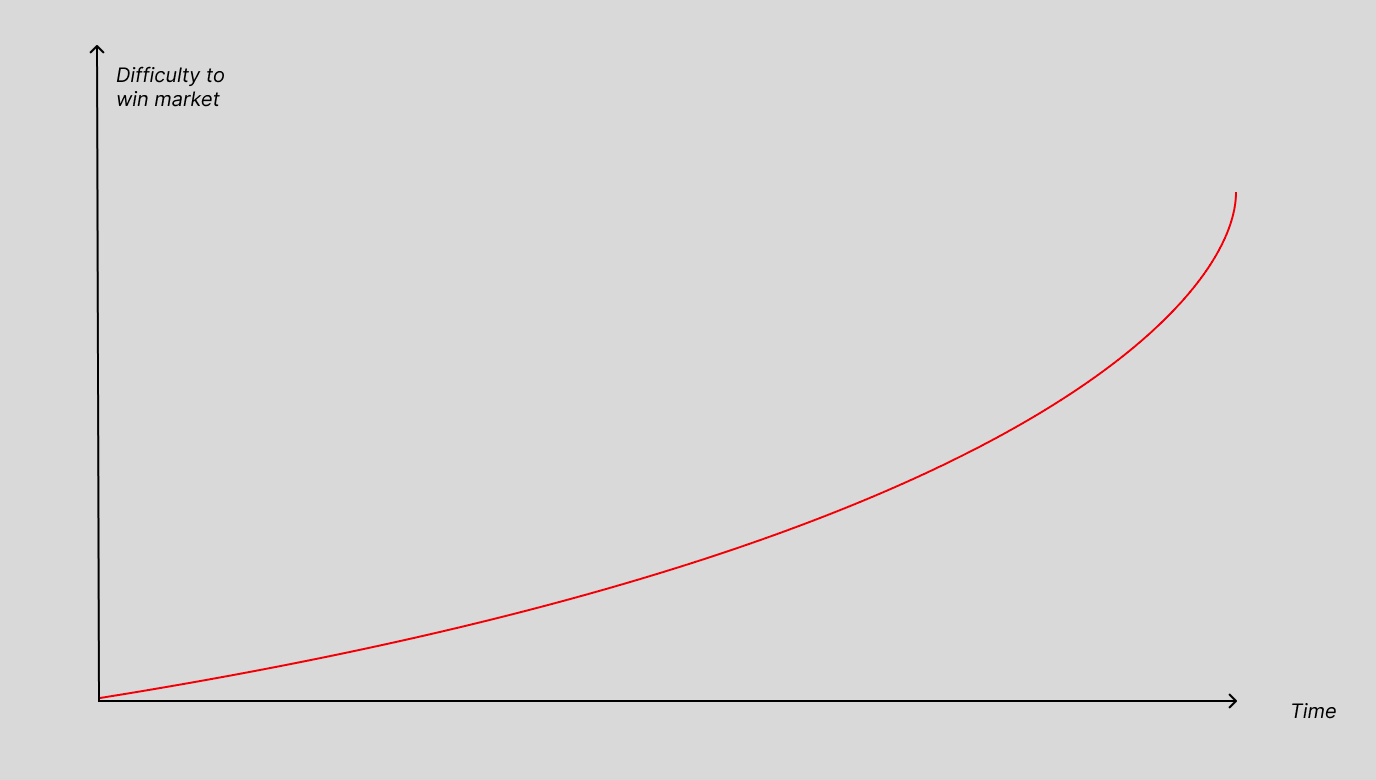

In new markets, all other things being equal, the difficulty challenger firms face when displacing incumbents continues to rise as, in theory, incumbent revenue begets capex which should result in continued innovation and customer satisfaction.

Fortunately for challengers, theory is not reality. The innovator’s window of opportunity arises as a new wave of customers (early players in the next app cycle) develop different use cases utilising non-obvious combinations of emergent infrastructure. This opportunity allows the creation of the next infrastructure cycle and is often led by folks who have solved novel use cases in the latest wave of the application cycle. As emergent infrastructure companies provide solutions for the next wave of applications, the previous application layer (that are now targeted by challengers) start assessing new infrastructure solutions to remain sufficiently competitive: thus, the nature of continuous innovation.

Of course, this is all well and good but it overlooks a small but crucial period within the cycle: how do infrastructure companies establish product-market-fit and cement their dominance against their fellow upstarts? In order to win the infrastructure race, companies must cement their status as a utility, as close to a monopoly as possible (although oligopolies are what most frequently result except for a few rare verticals). The reason this is so important is twofold:

first, as we have already mentioned, capital begets capex in pursuit of continuous innovation and customer satisfaction; and

there is continued margin compression over time in a land of finite TAM.

Infrastructure companies accidentally find themselves in a position similar to VCs: identifying verticals and winners that will demonstrate product-market fit and provide an increasing revenue stream over time. Ultimately, infrastructure companies are simultaneously looking for customers whilst also making bets on which companies will provide outsized returns. This leads to two core components of early-stage strategic decision-making:

go-to-market; and

product / feature composition.

When pursuing go-to-market, infrastructure plays need to:

Assess the TAM of the ideal customer profile;

Assess the teams and market opportunity (as if you were a VC) of customers to identify the likelihood to scale i.e. focus attention on high ROI customers; and

Support customers by establishing industry best practices, industry introductions, and proactive subject matter dialogue with regulators (akin to platform teams in VCs).

When assessing product/feature strategy, infrastructure plays need to:

Maintain razor focus on velocity;

Ensure feature deployments form a coherent product offering i.e. a narrative for growth and continued partnership; and

Closely align product feature development (even consider aligning incentives) with hypothesised ideal customer profiles.

Once product-market fit has been established, it is now time to cement your position as market leader and SCALE, SCALE, and SCALE. Good luck, you are now on the race to win; fundamentals are crucial for success. This is not a winner takes all opportunity but it is definitely winner takes most.

References:

Long Take: Lessons from the Application / Infrastructure cycle for future bets by Lex Sokolin

The Myth of the Infrastructure Phase by Union Square Ventures

Fintech Infrastructure Wars by Simon Taylor

The Copernican Revolution in Banking by Frank Rotman

If you are looking to build or are investing in what’s next, would love to chat - please reach out via DM on Twitter or reply via email 🙏