The Merge: The blurred lines of dual-track financial services

No, not that merge 😉 The increasingly blurred lines of DeFi and Fintech, and what to expect in an exponential opportunity

Welcome to another edition of the DeFi Mullet newsletter! In this newsletter, I hope to cover the arguably boring world of the most anticipated collab of the decade: Fintech x DeFi (ft. policy, markets, tech, product, etc).

If you are one of the fine folks who get a thrill from these topics, press subscribe below!

As I alluded to in The Current State of Under-Collateralised Lending in DeFi, there is a significant land grab happening right before our eyes: the merging of fintech and DeFi into a holistic dual-track financial services ecosystem. This should not come as a shock to the many folks who have witnessed the development of fintech over the last decade. Big fintech and big crypto are coalescing to seize the opportunity that has frustratingly eluded them in developed Western markets: the enviable status of a super-app. It is hard to describe the Western existential tragedy of not reaching super-app status whilst the likes of Rappi, Grab, GoJek, Paytm, and WeChat gallivants about with their impressive growth and speed of TAM expansion. The pursuit of super-app status in the West has been plagued by an incumbent brownfield financial services architecture that paralysed the opportunity for swiftly integrating and distributing strategically adjacent products. Incumbents were either too early (tech, product, and regulatory) or inadequately prepared to swallow the bitter pill of avoiding the perils of path dependence by defining a truly novel category. For many fintech folks in the West, the appeal of DeFi is that it presents a greenfield second chance to finally produce the coveted super-app. In the short term, blurring the line between fintech and DeFi may come across as a “CAC-hack” but it will be truly category-defining in the long term.

¡Vamos, Crypto! on Rappi

Mental models have emerged that categorise ecosystem players on a spectrum of centralised, partially decentralised, and fully decentralised. I posit that this is an oversimplification of what is ahead: it is my view that we are witnessing the development of a singular over-arching financial services ecosystem that blurs the line between traditional finance and decentralised finance. Further, it is my view that, due to a variety of factors such as regulatory pressure, technical debt, operational debt, and path dependence, incumbents will struggle to seize this opportunity unless they contribute to the public goods and new community-owned primitives that will power large scale interoperability. Behold, this is a tale of converging macro circumstances and a game of 4D chess.

Dual-Track Financial Services

As we continue to cross the chasm, we will need to manage complexity for the abundance of users living increasingly bifurcated financial lives. As much as we should strive for the broadest adoption of DeFi as possible, we must not forget to serve the best interests of users regardless of their level of financial sophistication. Development so far has been very much bottom-up which may ultimately result in the crystallisation of a bifurcated financial system rather than one that is most optimised for user liberty. There is an opportunity for either incumbents or challengers to innovate in user experience by compartmentalising and abstracting the complexity ordinary users are being exposed to.

A tad hodge-podge, no? The bottom-up emergence of a dual-track ecosystem

Examples of what dual-track financial services could enable:

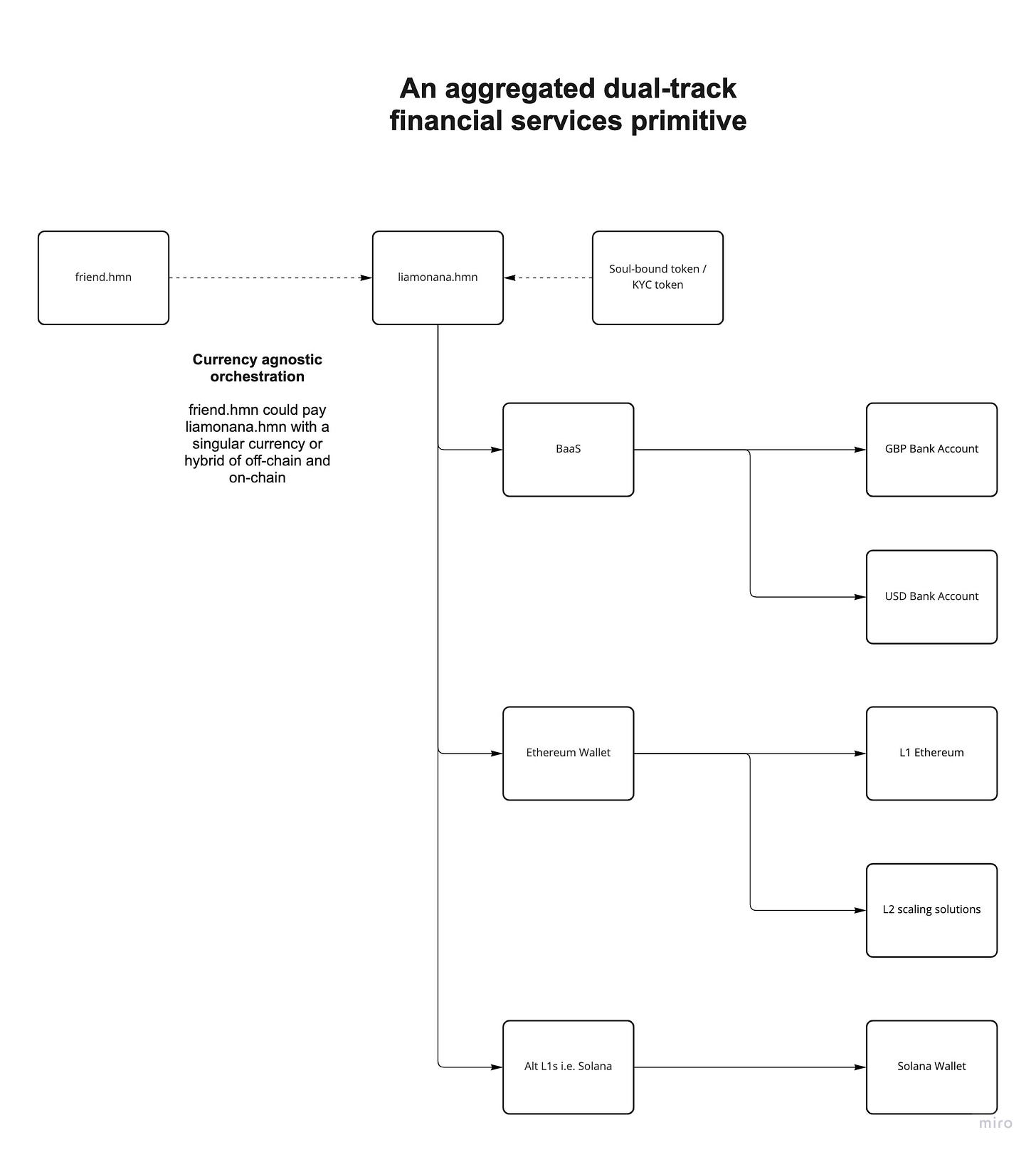

Split income (fiat + crypto) under a central identifier i.e. liamonana.hmn could be the overarching address that corresponds to my Ethereum, Solana, or BaaS-enabled bank account → simplified payments routing according to the denomination

Programmatic cross-track payments orchestration i.e. treasury management, cross-border e-commerce utilising the most efficient rails whether fiat or crypto

FX / exchange, offering both fiat and crypto enabled solutions at the point of execution → think 1inch but aggregating across fiat and crypto

Hybrid marketplaces that cut across fiat + crypto i.e. embedded fintech meets embedded DeFi

Dual-track investment products i.e. wrapped products could emerge such as a US Treasury Notes + stETH hybrid

Holistic dual-track tax assessment

lending lending lending, hybrid collateralisation and hybrid approaches to credit risk modelling

Putting the crumbs together

Dave, a financial services app, announced today a new partnership with crypto exchange FTX US and an investment of $100 million from FTX Ventures. The deal will enable the platform to begin offering cryptocurrency services.

Robinhood acquires Ziglu, 19 April 2022

With Ziglu, UK-based customers can buy and sell eleven cryptocurrencies, earn yield via its ‘Boost’ products, pay using a debit card, and move and spend money, even abroad, without fees. Like Robinhood, Ziglu believes that the new era of digital money brings a multitude of opportunities, and Ziglu exists to make those opportunities accessible to everyone.

Digital banking platform Revolut is working on expanding into decentralized cryptocurrency wallets and is also looking at the mortgage sector, its CEO said, as the London-based company pushes ahead with its strategy to become a so-called "super app".

Revolut, which currently offers payments services, crypto trading, savings accounts and stock trading, is focused in the short-term on expanding its remittance offerings and launching a buy now, pay later product. But the financial technology company has more work to do to become a one-stop-shop for financial services, said CEO Nik Storonsky.

Sam Bankman-Fried takes a 7.6% stake in Robinhood, 12 May 2022

Sam Bankman-Fried, founder and CEO of the cryptocurrency exchange FTX, purchased 56 million shares of HOOD. This gave him a 7.6% stake in the retail trading platform, according to the 13D filing.

Robinhood Announces Non-Custodial Wallet, 17 May 2022

We’re excited to announce that Robinhood is building a brand new non-custodial, web3 wallet that will allow customers to have total control of their crypto and seamlessly access the decentralized web and all the opportunities crypto has to offer.

This new, multichain, web3 wallet will launch as a standalone app and feature the same simple and accessible design that people have come to expect from Robinhood.

🤔 Hmmm, it all makes you think 🤔

A Robinhood classic: another waiting list

The why

A holistic dual-track financial services ecosystem sounds great but where is the utility? This is a common question posed by many, especially those that are sceptical (or cannot even comprehend the rationale) of the thesis underpinning the 4D chess being played by the likes of Robinhood, Revolut, and FTX.

The why for consumers requires bringing our mental model back to first principles. The three pillars for consumers are:

Self-determination, optimising for users being able to choose how best to live their own lives

Competition, believing that competitive and diversified markets offer the best outcomes for consumers

Identity, our transactions are the purest expression of who we are and what we believe

A core philosophical tenet that permeates what we are building is a belief that individuals are inherently capable of making decisions for themselves that are aligned with their own best interests. We believe that individuals are the arbiters of assessing their own risk tolerance and that guardrails are established on the principles of morality as defined in our social contract. We believe that increasing optionality across a broad set of criteria allows for more individuals to pursue a life in a manner that is best suited to their objectives, of which they can define these objectives for themselves. A perfect example highlighting this notion is Solana. For many of the decentralisation purists, Solana is the antithesis of what they believe to be the ultimate end-state of decentralisation. The nuance that is being overlooked is that not everyone ultimately wants or requires maximum decentralisation to live a life by the principles they deem most appropriate. It is the fact that individuals can choose between the traditional banking system, a protocol with some compromises on decentralisation whilst retaining many benefits, or a fully bankless decentralised life, that should truly be celebrated and allowed to flourish.

Brian Armstrong outlined the Coinbase Secret Master Plan in 2016

In a similar vein, we believe that competitive markets enable the best ideas to thrive and the creators of those ideas to be appropriately rewarded for their contribution to society. As a consequence of these market incentives, competition creates the best outcome for consumers as consumers choose, with their wallets, the best solutions that most appropriately address the requirements they prioritise. Competition and optionality allow for the efficient operation of markets and promote innovation as both DeFi and TradFi need to compete for consumer adoption. This, of course, is supported by the requisite level of consumer protection as determined by the operation of a society’s social contract.

An often overlooked aspect of our financial lives is the role our transactions play in shaping who we are and what we believe in. By allocating value, we are signalling to society what we believe to have value. Access to DeFi and the world of web3 is not only a question of liberty but also a question of freedom of expression. Much like the clothes we wear, the books we read, and the movies we watch, transactions are an expression of who we see ourselves to be and/or who we aspire to become. At a more macro level, whether or not we choose to use decentralised financial services is an expression of what we believe and our view of what we desire our society to aspire towards. A holistic dual-track financial services ecosystem allows us all to embrace the financial services primitives that best suit our needs and our beliefs as to what is best for our society → competition ensures we actually progress humanity.

Custodial crypto on Revolut

The obvious question: why is this not already a reality?

Regulatory environment

Using the downfall of Libra as an example, regulators have not been overly enthused by the idea of powerful incumbents becoming even more powerful; especially when those incumbents have a history of not necessarily playing within the spirit of the game. The companies that will win in this space will not only be cooperative with regulators but also be educators with respect to the adoption of best practices that reduce social harm and adhere to a society’s respective social contract. Given the size of what is at stake and the fact it is inherently cross-border, navigating an ambiguous regulatory environment will be a herculean effort.

Scale of underlying transactional architecture

Despite the significant advances being made in scaling solutions (whether that be Layer 2 Ethereum or higher throughput Layer 1s like Solana), if we shift transaction volume too quickly to decentralised protocols we will cause widespread network congestion. Block space demand needs to slightly outpace supply so as to incentivise competition to produce the best scaling solutions, up until a point where equilibrium is achieved and sustainable scale is obtained. Given the sheer size of traditional financial services, this will take some patience.

Interoperability / path dependence

As I discussed in On-ramps and Off-ramps: Fintech x DeFi Crossover, interoperability between DeFi and TradFi is currently a sticky wicket. For a holistic dual-track financial services ecosystem to truly flourish there needs to be seamless and inexpensive interoperability that is scalable and programmatic. As evidenced by Libra, incumbents can suffer at the hands of their own path dependence; rather than truly rearchitecting financial services, they envision a future that is a reflection of their own empirical world view. It is this notion that makes the quest for backwards compatibility so fraught with danger.

Data infrastructure

As with modern technology companies, transactional databases are not necessarily optimised for how data will be presented to a broad set of known and/or unknown subsequent users. This has led the to the development of a thriving ecosystem of companies that specialise in data storage (Snowflake), data transformation (DBT), data visualisation (Looker), and the broad discipline of MLOps. Given the composable nature of DeFi, projects such as The Graph and Ocean Protocol are building solutions to enable data transformation at scale so application layer builders can move faster when integrating on-chain data into their user-facing applications. There is a lot of data in financial services and this will also require patience.

Anish Acharya from a16z on the post bank fintech stack

We are not just witnessing the emergence of financial services super-apps in the West. No, we are witnessing the infancy of financial services ultra-apps that have the opportunity to displace incumbents across a much broader set of industries than many are recognising. An entity that architects a holistic dual-track financial services ecosystem that seamlessly bridges across DeFi and TradFi will be best placed to capitalise on a set of network effects that have yet to be previously witnessed. This is one of the biggest paradigm shifting opportunities in the broader context of financial services. Whether it be big tech, fintech (Revolut), centralised exchanges (FTX, Coinbase, and Binance), wallet providers (Zapper, Zerion, and Argent), or an entirely new set of players, there is an opportunity ahead of all of us where we can, and will, better serve the interests of consumers, institutions, and regulators concurrently.

If you are looking to build or are investing in what’s next, would love to chat - please reach out via DM on Twitter 🙏