YaaS: A framework for evaluating yield-as-a-service

An unfortunately timely analysis for analysing hybrid centralised/decentralised yield products

Welcome to another edition of the DeFi Mullet newsletter! In this newsletter, I hope to cover the arguably boring world of the most anticipated collab of the decade: Fintech x DeFi (ft. policy, markets, tech, product, etc).

If you are one of the fine folks who get a thrill from these topics, press subscribe below!

Speaking to folks who are either building or investing in the crossover of fintech and DeFi it can often feel like many are caught up by what appears to be the next shiny object. There can often be an air of thesis but in many cases, there is a fear of missing out making its way into decision making. When driven by FOMO it can be tempting to overlook the fundamentals by being caught up in the swell of momentum rather than relying on deeper conviction. Something that has had attention recently is the idea of offering yield-as-a-service (YaaS). It is a proposition that feels obvious: of course, we want to enable as many people as possible to simply access safe and secure exposure to the benefits of decentralised finance but it is important to remember that, in a gold rush, it is the opportunities which appear most obvious that require the greatest scrutiny. Many great companies are building in this space and I hope this post helps form a framework for identifying and celebrating them whilst also highlighting instances where market participants must aspire to do better.

Today’s post is part analysis and part temperature check: examining the decisions we all face when building products that operate on both sides of a dual-track financial services ecosystem.

What regulators don’t want to see

Framework for evaluating YaaS companies

There are some core questions that are useful to answer when evaluating YaaS propositions:

How does the solution work?

Where does the yield come from?

What types of risks exist vs what risks have been disclosed?

What is the state of the macroeconomic environment?

What is the state of the regulatory environment?

Pillar 1

How does the solution work?

The mechanism as to how YaaS services operate is relatively straightforward with a handful of key design decisions that impact the level of risk an end-user is ultimately exposed to.

Simply, we can think of yield-as-a-service as either:

An API solution that abstracts away the complexity of utilising DeFi protocols to provide an end-user with a % yield over a given period.

A user-facing application (standalone or a feature in a broader product suite) that provides an end-user with a % yield over a given period.

Standalone: outlet.finance, AQRU, donut.app, Zurp, DimeFi, Pebble

Feature: Gemini Earn, KuCoin Earn, Yotta CryptoBucket, YouHodler Earn, CoinLoan Earn, Celsius Earn (😱😱😱), Nexo Earn

It is also important to mention those companies that led the charge throughout the ambiguous regulatory environment thus far, both having very public run-ins with the SEC: BlockFi Interest Accounts and Coinbase Earn.

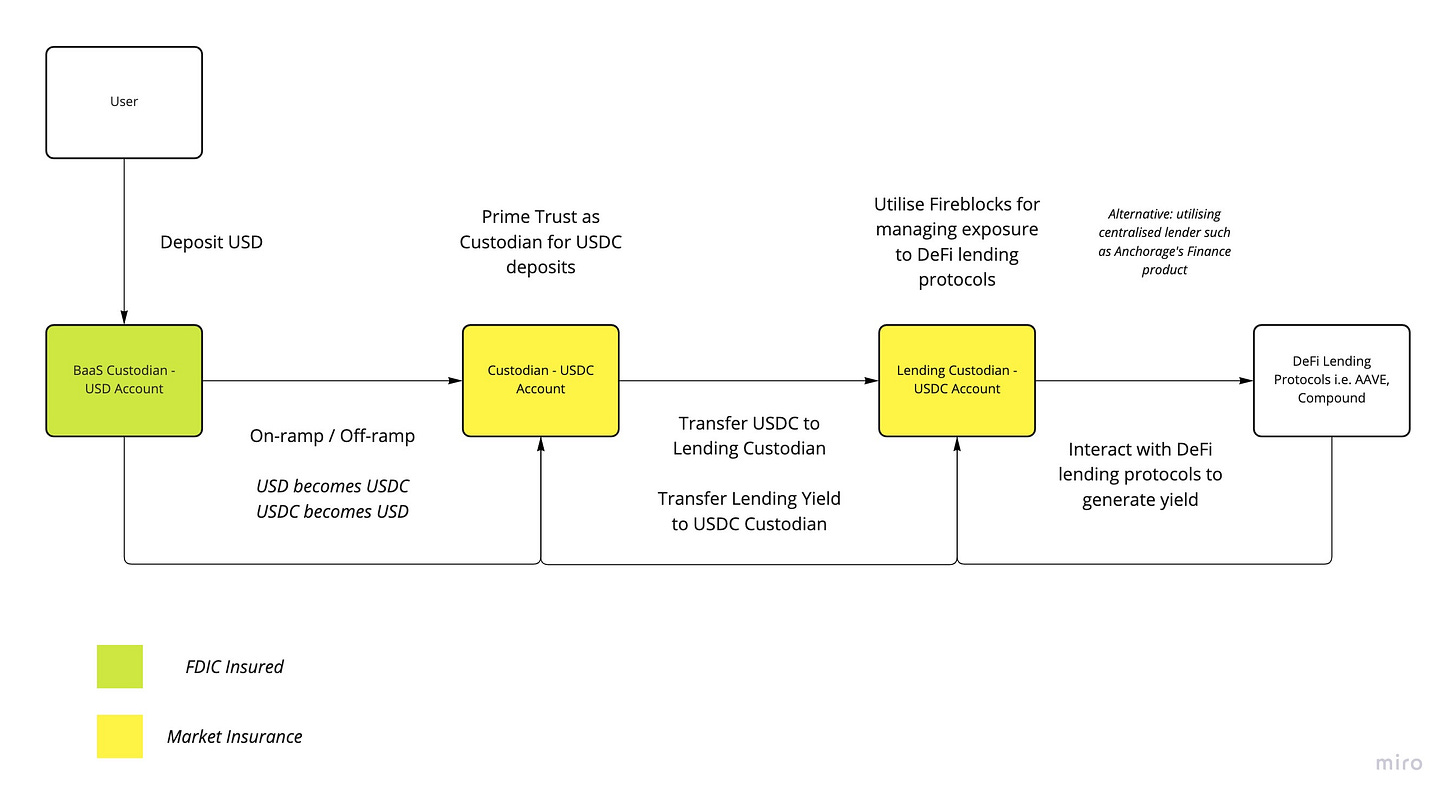

Best-in-class YaaS flow

Pillar 2

Where does yield in DeFi come from?

To assess the promises of yield made by YaaS providers, we need to understand the fundamentals of where yield in DeFi comes from. This has been explored previously by Ming Zhao, yuga.eth, and Joseph Pizzolato.

Demand for leverage

Think AAVE and Compound Finance → interest paid by borrowers is subsequently distributed to collateral providers

Staking revenue

For this discussion, we will refer to staking as a native token reward for helping secure a proof of stake chain i.e. Ethereum (Beacon Chain) and Cosmos

Options premia

Think Ribbon Finance, primarily covered calls → income received from the premium paid to the issuer of the option contract

Fees on the provision of liquidity

Think Uniswap and Curve → swap fees distributed to Liquidity Providers

Token rewards i.e. Protocol CAC

Incentives that are often paid out on top of another yield source to boost the rewards given to a user. This often takes the form of a project’s native token and the realisation of the boosted yield depends on continued market demand and liquidity for that asset.

It is important to note that not all yield is the same nor are these yield sources risk-free. One notable example of why the understanding of a company’s yield source is so important is that of Stablegains. Stablegains (YC Winter 2022) is a retail-facing YaaS offering that offered a 15% APY on USD deposits. Although Stablegains made representations that suggested yield was generated utilising USDC deposits in DeFi lending protocols, it has since been alleged that yield was being generated utilising UST deposited into Anchor Protocol on Terra.

Pillar 3

What types of risk exist vs what risks have been disclosed?

When offering financial services products to retail users it is crucial to be explicit in articulating the risks that are present in the allocation of capital to a particular product. In order to cross the chasm, as mentioned in The Merge, we as builders need to act with the utmost diligence and propriety. As much as we believe in our mission to facilitate competition within financial services, it must be done in a manner that is in accordance with the spirit of our existing social contract. Now, with that being said, let’s talk through some of the risks inherent in YaaS offerings - there are a lot of things that could go wrong:

Protocol risk

Code being used in an unintended way → smart contract risk

Economic design failure → tokenomic risk

Inability to redeem representative token i.e. cUSDC, aUSDC → redemption risk

Oracle failure → 3rd party data risk

Governance attack - 51% attack risk

Security risk

Rug pulls → team risk

Attack or failure of custodian → custodial risk

Market risk

Dramatic fluctuations in price → price risk

Drying up of liquidity → liquidity risk see Celsius and stETH

Borrower defaulting on repayment of loan → default risk

Stablecoin or LP token de-pegging → de-pegging risk see LUNA UST collapse

Yield decreases due to swap volume decline or swap fee is lowered → yield risk

Regulatory risk

Regulators decide to drop the ban-hammer, wot do? 🤔🤔🤔

To mitigate the risk an end-user is exposed to, YaaS providers must work with custodial solutions that have transparent and encompassing insurance policies; working with insurance providers that can offer institutional-sized coverage (see BitGo working with Lloyds). It is important to note that, despite cold-wallet custodial insurance, end-users remain exposed to risks such as redemption risk. On-chain solutions such as Nexus Mutual (i.e. Nexus Mutual’s Protocol Cover), at this point in time, do not have sufficient scale to underwrite policies of institutional size (12.5m DAI capacity for Compound V2 at a cost of 2.60% per annum).

It is important to note that synthetic hedging solutions for locking in future yield are not yet ready to be implemented at scale within DeFi. For the likes of Voltz Protocol, a synthetic interest rate swap AMM, there is a tremendous opportunity to allow YaaS providers to mitigate the impact of volatility on the APY % they are presenting to their customers. This is a core mechanism within traditional financial services and it should be expected that it will also become a core mechanism within a more mature DeFi ecosystem.

Finally, it would not be a discussion on YaaS without looking at the role of FDIC insurance (US) and FSCS protection (UK). It can be tempting for YaaS providers to draw comparisons between traditional savings accounts and YaaS offerings but (and this is an important but) they are not equals. FDIC and FSCS are state-mandated deposit insurance schemes that guarantee a user’s deposit (to a certain limit) in the event the financial services institution collapses and the user cannot withdraw their funds. Crypto solutions are not afforded similar last resort protection as they are not equivalent to savings accounts, they are investment products.

Now that we have outlined the risks an end-user is exposed to, we can evaluate an example risk statement made by a consumer-facing YaaS solution:

XXXXXX is not a bank, a broker or an investment advisor and your funds are not FDIC insured. However, XXXXXX implements several processes to secure your funds such as only working with over-collateralized lending protocols (i.e. borrowers must put up a collateral for the loan that is larger than the amount they are borrowing), only working with the most trusted and qualified partners and protocols (e.g. we partner with Plaid and Wyre to secure conversion of your money into digital assets and back), and incorporating regular audits as well as implementing the highest bank-level security, AML/KYC, and encryption standards

Ultimately, given what we know about the risk an end-user is exposed to, I will leave it up to you to decide whether this risk statement meets expectations.

Pillar 4

What is the state of the macroeconomic environment?

It is without question that YaaS solutions have come to market in a macroeconomic environment that continues to puzzle both professional and armchair economists. There are several factors that have deep implications for the long-term thesis underpinning YaaS solutions:

Interest rate environment

For the past decade, we have been in an unprecedented low-interest environment throughout much of the developed world. This has resulted in investors, both retail and institutional, chasing yield in asset classes that are traditionally considered to be of higher risk. A quick Reddit or YouTube search will avail you of hundreds of posts and videos on passive income or crypto savings account strategies.

CoinLoan comparing to retail banking interest rates

Inflation

In a high inflation environment, yield generated by the YaaS solution must be greater than the rate of inflation in order for end-users to generate real returns on their capital. The greater the spread between inflation and yield generated by the YaaS solution, the more appealing YaaS is as a destination for capital. YaaS solutions can also be utilised in hyper-inflationary environments where access to stablecoins pegged to an alternate fiat denomination (i.e. Turkish Lira vs US Dollar) can provide users a shield against inflation caused wealth erosion.

Builders and investors must evaluate the medium-long term implications of interest rate rises and inflation on their business model: second-order effects may include increased CAC, reduced deposit size, and LTV compression due to increased periodic retention incentives. Ultimately, folks must make an assessment on whether a changing set of macroeconomic circumstances will fundamentally inhibit their pathway to scalability.

Pillar 5

What is the state of the regulatory environment?

First and foremost, YaaS builders and investors need to engage a securities lawyer regardless of the jurisdiction they intend to operate in. Yield bearing crypto products have recently been in the spotlight following the publication by the SEC of the Order Instituting Proceedings against BlockFi Lending LLC (BlockFi); it goes without saying that this is essential reading. The SEC was quite clear in its approach to aggressively utilising existing judicial tests (namely, The Reves Test and The Howey Test) to label crypto yield products with debt-like features as securities. That being said, there may be hope (see BlockFi hiring a lobbying firm) in the medium-term as noted by Commissioner Peirce in her Statement on Settlement with BlockFi LLC (emphasis added):

More importantly, what ends does this Investment Company Act exercise serve? The Form S-1 already should satisfy the information disclosure objective at the heart of this settlement. Finding a way not to be subject to the Investment Company Act would not seem to serve an additional protective purpose. If the Commission believes that additional protections are needed to make up for not being covered by the Investment Company Act protections, then we could work with BlockFi under our Section 6(c) exemptive authority to craft a bespoke set of conditions that make sense in this context. The Section 6(c) process also lends itself better to public input, which seems appropriate given that today’s settlement will reverberate beyond just the settling entity and will affect competing crypto lenders and their customers as well.

When thinking through opportunities for regulatory arbitrage, we must remember the adage “nobody gets fired for choosing IBM”. Much the same can be applied to how regulators across the world approach implementing regulatory reform: regulators will look to other markets and often adopt approaches that have already been tried and tested in analogous economies and jurisdictions. Builders and investors in markets similar to the US would be wise to familiarise themselves with the views of the SEC and make informed conclusions on the future applicability of this guidance in their home jurisdictions. An obvious example is the SEC’s guidance on likening YaaS products to traditional savings accounts:

Companies offering interest-bearing accounts for crypto assets do not provide investors with the same protections as do banks or credit unions, and crypto assets sent to those companies are not currently insured. As a result, you should not expect the same level of security, safety and soundness with these crypto asset interest-bearing accounts that you have with bank or credit union deposits.

View for the future

There is little doubt that enabling retail and business users to safely and securely access YaaS solutions is aligned with our broader mission of facilitating competition in financial services. That being said, we must remember that all eyes are on us and there still remain many who wish us to fail. It is in our collective best interest as builders of the future to continue adhering to best practices in mitigating risk whilst also proactively working with and educating progressive regulators. YaaS is a simple and scaleable solution that has a part in onboarding the next billion users to DeFi.

If you are looking to build or are investing in what’s next, would love to chat - please reach out via DM on Twitter or reply via email 🙏

Very well written article, thanks!

One observation;

the pattern seems to be to follow and replicate what's there is traditional finance (atleast conceptually) but deliver high yields (a promise that may or may not be posisble to do sustainably) instead of any new ideas in DeFi world (meaning the ideas not so far used in TradFi)

- if the ideas are same from TradFi, do the problems seen/unseen also follow into DeFi?